Elderly’s bid to spend wealth to avoid paying care sees councils face £1.62bn bill

The number of people prepared to spend their wealth now to avoid paying for care later has almost doubled, leaving councils in England facing a bill of £1.62bn a year.

The amount of people who would be happy to reduce their assets below the £23,250 threshold to ensure councils foot the bill for their long-term care has risen from 23 per cent in 2013 to 43 per cent this year, according to the health insurer Partnership.

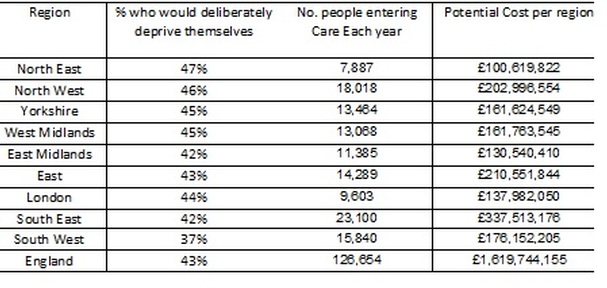

With an estimated 126,000 entering care each year, the insurer’s Care Report suggests this could see councils paying the extra £1.62bn in England, if all of those who say they intend to spend their wealth, actually do.

The report shows how councils in the South East (£338m) and East (£211m) are likely to be most impacted due to the high number of costly care homes.

The research is based on a survey of almost 10,000 people.

Some 47 per cent of those in the North East of England (the region with the highest number of people claiming council support for adult social care) are the most likely to say they would spend their wealth and fall back on the state for support.

The over 45s surveyed believe £25,797 was a reasonable figure to expect people to pay before they received state funding. This is 14 per cent below the cost of one year in an average residential home (£29,558).

“While the second tranche of the Care Act with its associated implications has been delayed until 2020, councils still face a significant financial burden – which is set to grow considerably if even a third of these people deliberately deprive themselves of their assets" said Jim Boyd, director of corporate affairs at Partnership.

He added: “Spending or giving away your wealth before you need care might seem attractive but it does limit your options and means that you are likely to have far less control over your future than you may hope.

"This is unlikely to lead to a satisfactory outcome for anyone.”

There are 433,000 older or physically disabled adults living in residential care settings across the UK, and those over the age of 65 are due to make up 25 per cent of the UK population by 2046.

However, according to the Care Report, individuals continue to see care as ‘something that happens to other people’ and 82 per cent of those over the age of 45 surveyed admit they had not thought about their care or spoken to their families about it.

Some 72 per cent of those over the age of 45 stated it wasn’t likely that they would go into residential care and almost two thirds (61 per cent) said they do not want to go into a care home.

When asked what their preference was, 73 per cent said they would rather have care in their own home.

While domiciliary care [£10,949 per year for 1.8 hours per week] is cheaper than residential care [£29,558 per year], the average pension income is £15,400.

Almost a third (30 per cent) of over-65s plan to move in with their children if they cannot cope but only six per cent have actually mentioned this to their family.

Of those over 45 years surveyed, 30 per cent did not realise that the Care Act’s care cap of £72,000 had been delayed to 2020.

Councils also face a £1bn bill as part of costs associated with the incoming living wage.

As part of plans announced by Chancellor George Osborne, ahead of this week's Autumn Statement, councils will be given the power to raise council tax by an additional two per cent to help meet councils' social care costs.

To view Partnership's Care Report visit www.partnership.co.uk/dmsdocument/550

Latest News

29-Jul-24

Dementia Bus gives carehome.co.uk staff insight into life with dementia

29-Jul-24

Dementia Bus gives carehome.co.uk staff insight into life with dementia

01-Mar-24

Find out the top care homes in 2024

01-Mar-24

Find out the top care homes in 2024

21-Mar-23

UK's top care homes in 2023 revealed

21-Mar-23

UK's top care homes in 2023 revealed

03-Jan-23

carehome.co.uk launches free care helpline

03-Jan-23

carehome.co.uk launches free care helpline

13-Dec-22

5 mins with Emily Whitehurst, chief operating officer for Constantia Healthcare

13-Dec-22

5 mins with Emily Whitehurst, chief operating officer for Constantia Healthcare